![]()

ZeroHedge:

Americans Have Lost $20 Trillion Since The Start Of 2022

Citing estimates from JPMorgan, over the weekend Bloomberg wrote that courtesy of a Biden administration terrified of what soaring inflation will mean for the Democrats in the midterms, and a Fed that is determine to do anything – even crash the market and spark a recession – to do Joe Biden’s “kill inflation” bidding, the US faces a new scary threat: a plunge in wealth which JPM estimates at least $5 trillion, and could reach $9 trillion by year-end.

In short, the world’s richest nation is waking up to an unpleasant and unfamiliar sensation: It’s getting poorer… and worst of all, it’s getting poorer at the behest of its own leaders.Since the start of the year, the S&P 500 Index is down 18%, the Nasdaq 100 has lost 27% and a Bloomberg index of cryptocurrencies has plunged 48%. That all amounts to “a wealth shock that is set to drag on growth in the coming year,” JPMorgan economists led by Michael Feroli wrote in a note Friday.

Of course, this is not news to regular readers who have known about this one unpleasant side-effect of Biden’s phobia for higher prices: we pointed out as much almost two weeks ago.

$20 trillion in household net worth wiped out in 2022

— zerohedge (@zerohedge) May 11, 2022

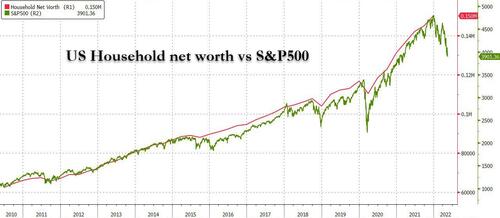

We do however disagree with JPMorgan that “only” $5 trillion has been lost so far: as the following chart shows, US household net worth – which consists almost entirely of financial assets (and a smattering of real estate) – tracks the S&P with an almost 1.000 correlation. Well, that means that with the S&P briefly entering a bear market on Friday and sliding approximately 20% from its all time high, reached just a few days into 2022 when US net worth hit $150 trillion, it means that US households have seen about $20 trillion in net worth disappear in 2022 under Joe Biden, a loss far greater than under any other US president in history.

One reason why Biden hasn’t freaked out over this record crash in US household net worth, is that so far, the richest Americans have borne the brunt, with US billionaire fortunes down $800 billion since their peak amid the sharp losses in stocks, crypto and other financial assets.Billionaires were the biggest winners of 2020 and 2021. Now they’re losing more than almost everyone else. The Bloomberg Billionaires Index, a daily measure of the wealth of the world’s 500 richest people, has dropped $1.6 trillion since its peak in November.

Leading the way are the Americans on the index, who have lost $797 billion since their peak. Perhaps the most humbled by it all is the world’s richest person, Elon Musk. He’s lost $139.1 billion, or 41% of his wealth, since November, when his net worth briefly surpassed $340 billion. Amazon.com Inc. founder Jeff Bezos, the second-richest person, lost $82.7 billion, or 39% of his peak wealth.But that’s just the beginning, and surging interest rates are also starting to rattle the housing market, where middle- and working-class families have the bulk of their wealth.

It all adds up to the sudden removal of a major prop to confidence: ever-bigger nest eggs, which of course is on purpose: in its attempts to stamp out the highest inflation in decades, the Fed needs Americans to curb their spending, even if it requires an economic slowdown to get there. However, it still remains unclear just how the Fed hopes to snuff out supply-side inflation which the Fed’s actions have no control over.

In any case, neither the rich nor the poor are happy:

“It’s painful to get back to normal after really being in a fantasy world last year,” said John Norris, chief economist at Oakworth Capital Bank. “It’s going to feel a lot worse than it actually is.”

[the_ad id=”157875″]

Maybe, but it’s already feeling quite terrible for most, and according to the latest Biden approval poll, things have never been worse, with nearly 70% saying the economy is bad, that the senile president is “slow to react when issues arise”, and that the state of the country is “uneasy ” and “worrying.”

Tough Biden poll from CBS News:

• 69% say economy is "bad"

• 65% say Biden is "slow to react" when issues arise"

• 63% describe state of the country as "uneasy" and "worrying" https://t.co/V4abLwfMHp— Axios (@axios) May 22, 2022

All we can add here is: just wait another 2.5 years of Biden rule.

And while the wealth losses among the top 0.001% do in fact reduce inequality, that won’t be much comfort to most people who worry about the U.S.’s widening disparities, especially those who only pretend to worry – like most socialist Democrats – while in reality hoping to become ultra rich themselves by being career politicians who never actually achieve anything but merely talk about it (and in the case of Nancy Pelosi, putting on some quite profitable trades).

“In a relative sense, it’s going to make the inequity a little lower — but in an absolute sense, everyone suffers,” said Reena Aggarwal, director of Georgetown University’s Psaros Center for Financial Markets and Policy.

Like many, Aggarwal is concerned that falling markets will create problems for the broader economy. “Some correction was needed but this is a pretty huge correction, and it’s not stopping.”

The NYT is loving Musk losing a lot of money, trying to tie it to his support of free speech. There have been numerous NYT articles covering it. But, he’s just another guy getting it up the ass from idiot Biden and his idiot policies.

Idiot Biden is destroying this country and its economy and all they can think of to correct their mistakes is continue doing what is killing us.

joe’s support staff spins and spins.

One economist on his staff claimed that the economy was “great,” as Americans were “spending more than ever.”

Yup, inflation eats up your paycheck so you need to spend more to buy the same things that were cheaper before.

And joe calls that “great.”

Actually, joe’s inflation is a TAX on Americans’ purchasing power.

Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.

Ronald Reagan

Joe’s just getting started. But at least no more mean tweets.