![]()

by MATT TAIBBI

On March 9 of this year, as I was testifying before Ohio congressman Jim Jordan’s House Weaponization of Government Committee in Washington, an IRS agent came to my home. After some soul-searching I contacted the Committee, which to my surprise aggressively pursued the case, leading first to disturbing revelations, and later to a rare piece of good news: the Treasury Department promised to “end most” home visits.

Three months later, the excellent staff at Jordan’s Committee released a report on the issue. Particularly via an example involving a resident in Marion County, but also through some general details that shed additional unnerving light on my case, it reveals problems far worse than I imagined. If the IRS hasn’t in fact curtailed “most” of these visits, we’d better hope it does, and soon, as this program has the potential to generate real unrest in a hurry.

The most unsettling revelations involve a bizarre incident from about a month and a half after my case, on April 25, 2023. On that date, a woman was visited at her home by a man identifying himself as “Bill Haus” from the IRS’s Criminal Division. He then “informed the taxpayer he was at her home to discuss issues concerning an estate for which the taxpayer was the fiduciary,” and after sharing “details about the estate that only the IRS would know,” the taxpayer “let him into her home.”

The woman informed “Haus” that the estate issues had been resolved, and furnished documents to prove it. At this point, he informed her of his real purpose, claiming she was delinquent on several tax filings and provided “several documents to the taxpayer for her to complete.”

Hesitating, the woman offered to put him on the phone with her accountant, but when he didn’t answer the phone, she contacted an attorney, who “repeatedly told Agent ‘Haus’ to leave the taxpayer’s home since the taxpayer had not received any prior notice from the IRS of any issue.” The agent reportedly replied that he was with the IRS and could go into anyone’s house at any time, and before leaving told the taxpayer she had “exactly one week to satisfy the remaining balance or he would freeze all her assets and put a lien on her house,” as the Committee report put it.

Once “Haus” left, the taxpayer feared a scam and had the good sense to immediately contact the Marion, Ohio Police Department (MPD), upon whose reports this story ends up being based. (Emails published below.) The MPD ran the plate of “Bill Haus” and found it came back to a car owned by someone with a different name. The police contacted the car owner, who “attested that he was an IRS agent but admitted Bill Haus was not his real name; he was using an alias.”

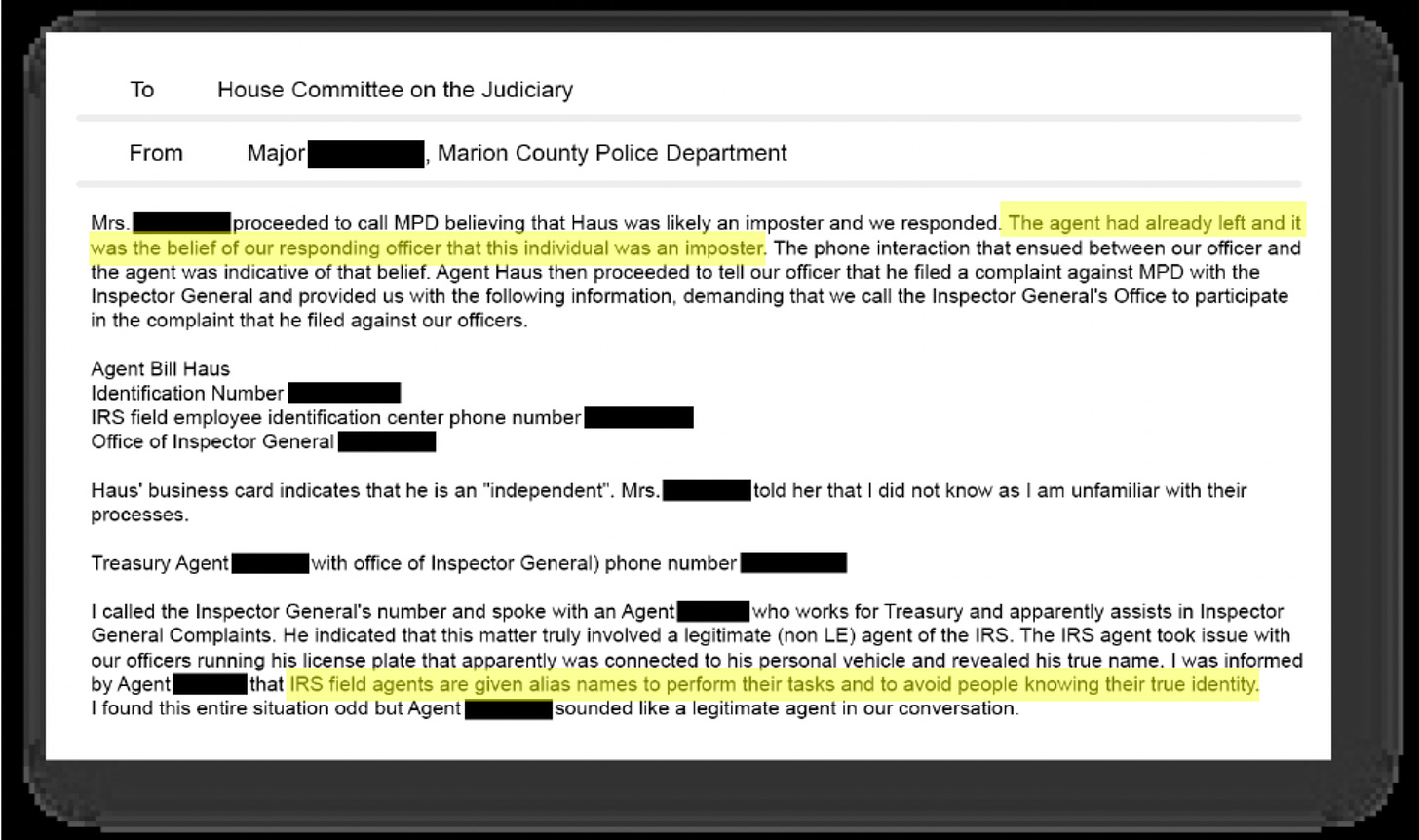

After the MPD’s first call to “Haus,” a report from the officer shows even local police thought he was a fake:

[Agent ‘Haus’] advised me that he was an IRS agent and I did not believe him . . . . I then called the Summit County Sheriffs Office and explained to them the call that I handled and that it appears that [Agent ‘Haus’] is going around pretending to be an IRS agent…

Now for the really crazy part. “Agent Haus” was indignant at police discovery of his identity and filed a complaint against the MPD with the Treasury Inspector General for Tax Administration, or TIGTA. Only when a senior officer from the MPD called TIGTA to respond to this complaint were they able to confirm that “Haus” was “a legitimate IRS agent.” Emails to the Committee not only show they initially believed him to be an “imposter” still, but eventually learned, from a Treasury officer who handles Inspector General complaints, that IRS agents who make home visits “are given alias names… to avoid people knowing their true identity”:

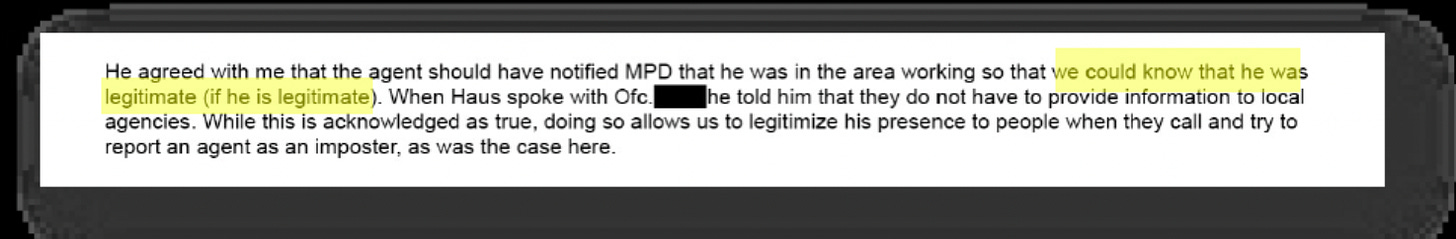

Not only did TIGTA confirm the details of the incident to police, they admitted to the MPD officer that “the agent should have notified MPD that he was working in the area” so “we could know that he was legitimate (if he was legitimate)”:

Pause here to consider the numerous problems already confirmed, to police, by the IRS:

- IRS agents make field visits using aliases;

- IRS agents make “pretext” visits, i.e. they announce they’re asking about one thing, when really by their own admission, they might be investigating something else;

- The IRS makes local, covert home visits without informing local authorities.

Think of the problems that could arise from the last issue alone. According to the exchanges, the IRS isn’t required to inform local officials of investigative activity, but as noted by the TIGTA official in communications with the MPD, this is something they should do, to avoid mixups. Here for instance, even after a lengthy inquiry, local police were unsure “Agent Haus” really worked for the Treasury. Imagine if the taxpayer called police to come over during her visit, and think of the things could go wrong. It’s insanity that the Treasury would have investigators using aliases making Clockwork Orange-style “surprise visits” without informing local officials.

The TIGTA officer tried to reassure police that IRS agents only make such visits after the taxpayer receives advance notice by mail. However, as in my case, there had been no such advance notice here. How would anyone be able to distinguish between an undercover IRS agent and a trespassing scammer? A major at the MPD called TIGTA to ask how the citizen could file a complaint, and the MPD was told “it would be a waste of her time.” Not until May 4th was the taxpayer able to speak with “Haus’s” supervisor, who confirmed she did not, in fact, owe money. He apologized, saying “some things that were said were wrong . . . things never should have gotten this far.”

The IRS told the Committee weeks later that the case was closed, and a day after that sent a letter explaining that the alias issue was not standard procedure:

The IRS has long provided training and procedures to promote the proper customer experience, and also for confirming our identity for taxpayers and local law enforcement upon request. The interactions described to us suggest those procedures were not followed.

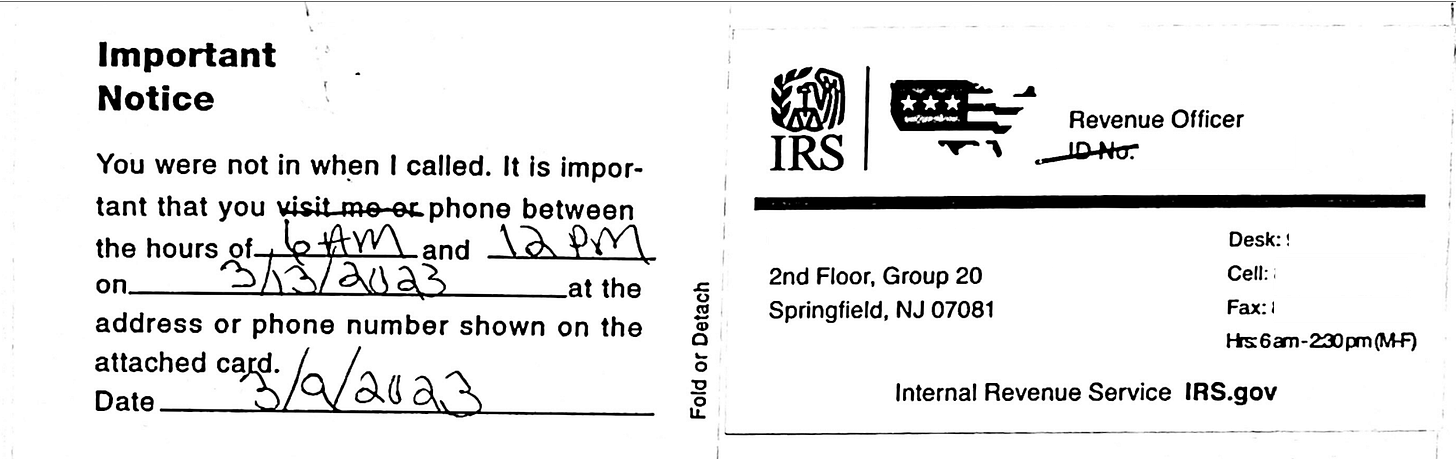

The report also reviewed my case, which had some similarities to the Ohio incident. As Racket readers know, I was visited by an agent who left a note asking me to call in four days (does anyone else find it odd that calling right away was not okay, but calling at 6 a.m. four days later would have been?):

The Committee report contains general information raising new questions about that visit. It says the Committee learned unannounced field visits have traditionally been reserved for “rare cases” involving serially unresponsive taxpayers, and that most issues are dealt with through the IRS’s “Automated Collection System,” or ACS.

The government in control presently is an enemy of the people. This is not the America bequeathed to us.

UNIPARTY started “weaponizing” Fed Govt fo 22 years ago. Stopped for a short time 2017 to 2020. It has been criminal – to the Feds- to be against the UNIPARTY SINCE HERR MUELLER TOOK OVER 9/4/01.

It is no accident that Herr M lead the attack on Don starting in 2015! Don loudly told us how bad the UNIPARTY is/was! That the dossier was forged/bogus should not be a shock!

But not for sons of Democrat politicians. No matter how much that owe, how whacked out on drugs they stay or how hard to reach they are, they get the “total pass” treatment. But, the “personal visit” treatment is reserved for the little people who have little or no means to fight back.

I would be interested to know what this lady looked like. Did “Agent Haus” expect to collect a different type of “payment”? When an agency is totally out of control, anything is possible and Democrats, weaponizing the agencies against political opponents, allow them to get out of control and go rogue.