![]()

While the media is tearing apart Hillary Clinton for “misremembering” a sniper incident (you know how often that kind of stuff happens in our day to day lives, so its no big leap to believe her) they are ignoring some other tall tales. The Obama tax files from 2000 on have been released and well, lets just say that somehow, someway, they managed to scrape by on a meager couple hundred grand. Of course making so little they couldn’t find any extra for charity either. From The TaxProf Blog:

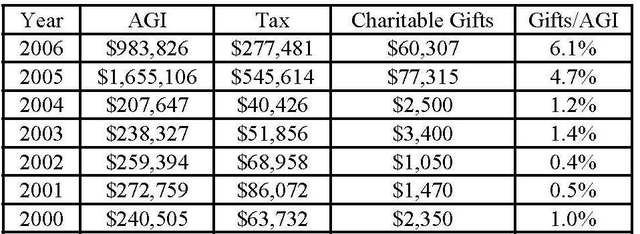

What is surprising, given the recent controversy over Obama’s membership in the Trinity United Church of Christ, is how little the Obamas apparently gave to charity — well short of the biblical 10% tithe for all seven years. In two of the years, the Obamas gave far less than 1% of their income to charity; in three of the years, they gave around 1% of their income to charity. Only in the last two years have they given substantially more as their income skyrocketed — 4.7% in 2005 and 6.1% in 2006.

Whats the story? The fact that the woman who wants to be First Lady has been out “misremembering” how well off they have been:

As she has many times in the past, Mrs. Obama complains about the lasting burden of student loans dating from her days at Princeton and Harvard Law School. She talks about people who end up taking years and years, until middle age, to pay off their debts. “The salaries don’t keep up with the cost of paying off the debt, so you’re in your 40s, still paying off your debt at a time when you have to save for your kids,” she says.

“Barack and I were in that position,” she continues. “The only reason we’re not in that position is that Barack wrote two best-selling books… It was like Jack and his magic beans. But up until a few years ago, we were struggling to figure out how we would save for our kids.” A former attorney with the white-shoe Chicago firm of Sidley & Austin, Obama explains that she and her husband made the choice to give up lucrative jobs in favor of community service. “We left corporate America, which is a lot of what we’re asking young people to do,” she tells the women. “Don’t go into corporate America. You know, become teachers. Work for the community. Be social workers. Be a nurse. Those are the careers that we need, and we’re encouraging our young people to do that. But if you make that choice, as we did, to move out of the money-making industry into the helping industry, then your salaries respond.” Faced with that reality, she adds, “many of our bright stars are going into corporate law or hedge-fund management.”

It appears that prior to those books coming out they were doing just fine. Even better then fine, they were up in the upper percentile of wage earners….

And then we have this from The Volokh Conspiracy:

The first thing that jumped out is that in some years Barack received no speaking fees or honoraria. Apparently, as an Illinois state legislator through 2004, Barack was prohibited from taking honoraria for speaking under the Illinois Governmental Ethics Act.

But what about Barack Obama’s 2000 and 2002 tax returns?

2000: On his 2000 Schedule C-EZ, Barack reported that he received $16,500 as a “Foundation director/Educational speaker.”

2001: On his 2001 Schedule C-EZ, Barack reported $98,158 from a Chicago law firm, Miner, Barnhill, for “Legal services/attorney” (and nothing for speaking).

2002: On his 2002 Schedule C, Barack reported $34,491 for “LEGAL SERVCES / SPEAKING FEES.”

These “speaking fees” are in addition to the amounts that Barack was paid as an employee, a lecturer at the University of Chicago, reported on the first page of his 1040s.

The Illinois Governmental Ethics Act (apparently last changed in 1995) provides:

(5 ILCS 420/2-110)

Sec. 2-110. Honoraria.

(a) No member of the General Assembly shall accept any honorarium.

(b) As used in this Section:

“Honorarium” means a payment of money to a member of the General Assembly for an appearance or speech, excluding any actual and necessary travel expenses incurred by the member of the General Assembly (and one relative) to the extent that those expenses are paid by any other person.

Maybe just another case of misremembering, this time his own States ethics act.

But no worries, I doubt the MSM will spend too much time kicking up a fuss about these things when there are snipers in the air and messiahs to worship.

See author page

As far as the charity thing goes, I can understand. The only reason why charity is listed on the tax form is for a tax write off. There is no law that one has to state a deduction. A person that has a kid doesn’t have to put the kid down as a dependent and claim the deduction for example. Then there is a case of audit flags. The more deductions one makes, the more likely the filer will be hit by an audit. If one is hit by an audit, they have to show proof that they did send the money to charity. I’ve never seen a person ask for a reciept when giving money to a church, buying candy for a school or putting money in Salvation Army pot etc.

I don’t think Obama was ever poor or even middle class. Living in Hawaii alone is expensive not to mention going to one of the most expensive schools in the state would probably require lots of money. I’m guessing his familiy was rich enough where he wouldn’t have gotten enough scholarship money for Harvard (I couldn’t get scholarship money because my parents lived in a house worth $200,000 at the time which was bought for under $18,000 in the late 1960s). His wife also went to Harvard and Princeton. They got this money through student loans.

In fact, from 2000-2004 they were in the top 5% and from 2005-2006 they were in the top 1% of all house holds. If their household had made over $57,500 in 2003 dollars they were in the top 25% of all U.S. households.

http://moneycentral.msn.com/content/SavingandDebt/P134742.asp?GT1=7392

Now what is more telling to me than the charity is this whole Harvard thing. The cost in 1989 for three years of Harvard Law school was $62,200 (not including material and living expenses) with $25,000 for public service jobs which also paid down the student loan. So if both had graduated in 1989, the debt of $124,400 with a house hold income of $50,000 + debt forgiveness. The average wage was $22,018 and the average cost of a house was $148,800 I’m thinking it’s the same scale when they were starting out.

http://cwn6237.k12.sd.us/trivia.html

I believe they were able to get these loans by having the collateral from their families and when they did leave Harvard, they made more than the average worker from the begining. They were always at least upper middle class and neither one should be complaining about economic hardships which they both have.

I thought Democrats were supposed to "care" more about helping the poor and less fortunate?

So, why is it that Republicans and conservatives make the lion’s share of all charitable giving?

Hillary Clinton is no better than Obama. Remember the time she claimed Bill and Chelsea’s used underwear as a charitable deduction?

Meanwhile, Dick Cheney continues to give millions to charity.

Let’s look at the last two years…combined AGI of $2.6 million, taxes paid of $823,000, and charitable gifts of $137,000. This is somehow BAD?

Oh, and if you think that an income of $250,ooo is "just fine" for raising kids, planning for their future (education and the like) while preparing for one’s own retirement, I would beg to differ. Our family of six doesn’t make that much money, but I could easily eat up $250K among college funds, retirement planning and current cost of living. When your income rises (especially if it rises sharply), do you immediately crank up the spending or jack up the charitable contributions, or do you take care of loose ends first? What about the year that their income fell, but their contributions more than tripled?

As far as Cheney is concerned, here’s an an opinion from TaxProf Blog:

Not quite as wonderful as one might think at first glance…but one must admit that Cheney has been a millionaire longer than has Obama, yes? I think that there’s a hint of apples-and-oranges in this comparison.

I don’t even want to get into the question of tithing; that’s a matter between the individual and God. I’ve heard respectable preachers suggest all sorts of things on the matter, from "God doesn’t want you to tithe until your own financial house is in order" to "God wants 10% off the top" to "The tithe comes from your whole person–time, talents, and love–and writing a check, no matter how big, doesn’t get you out of it." I’m not going to criticize anyone on that score; it seems a rather shallow attack to me.

The one real area of concern here is the question of speaking fees and Illinois ethics laws; if he broke the law, he should suffer the consequences.

Geez, the posting code totally wasted my paragraph breaks and indentions…but the new editing capability saves the day! Thanks for adding it!

Because of this guys gut feeling? Are you serious? The fact is he gave money that was owed him to charity, a lot of it. Whether you like where it came from or why…he gave it.

Obama, the messiah, the man of the people, gave little.

Thats going to be your argument? That 250 grand a year really isn’t much? Wow…..since the median income in Illinois is 51 grand a year I really don’t think that argument will hold water.

Myself, I think that is their prerogative to earn that much. Good for them. That is the American way to have the freedom to earn well. But don’t go around telling everyone how hard it was for you, how you had to take low paying jobs and other baloney when nothing could be further from the truth.

"Not quite as wonderful" refers to leveraging benefits of Katrina-relief legislation for non-Katrina charities; it’s one of those "spirit of the law vs. letter of the law" things. You’re right to say that it’s great that he gave it–and, make no mistake, it truly is–but what does that have to do with fitness to lead, other than (perhaps) providing ammunition for cheap shots?

Mike’s simple "Meanwhile, Cheney continues to give millions to charity" comment seemed to hang the VP out there as some sort of role model, but Cheney has had what, three more decades to amass wealth? My only point is that, when one has $22 million in after-tax income in a single year, one can be more charitable afterwards; that’s why I say there’s an apples-to-oranges element in that comparison. Who can say what any of us would do with $22 million (more, I would assume, since he undoubtedly has other savings and investments) in the bank?

I suspect that, in general, most politicians ramp up their charitable contributions as their career progresses. Whether that is due to increased wealth, concern for public image, or actual charity is left open to interpretation. More to the point, however, is that we cannot ascribe motive to any of it. Pointing at someone’s contributions and naming them a hypocrite is just cheap-shot attack politics. Picking out one piece of church doctrine and implying that someone is less than "Biblical" is a cheap shot as well; do you REALLY want to go there?

I don’t really pay that much attention to charitable donations, anyway, and (as I said earlier) I certainly don’ t hold candidates to a tithing expectation when churches don’t even agree on what a tithe is. You look at Obama and say "he didn’t give much back then," but I see that his contributions are increasing and think, regardless of the intent behind that increase, it’s a good thing.

There are many issues on which Obama (and Clinton, and McCain) can be legitimately criticized, but this seems…lame.

Now that the Obamas have hit pay dirt with Barak’s books, why doesn’t Michelle practice what she preaches and give up her 6 figures job and become a 5 figures nurse, teacher, or social worker.

There are many people would like to have a community services oriented job but can’t because they couldn’t pay their bills if they did.

Michelle isn’t encumbered by such financial necessities, is she? Just another "let them eat cake" limousine liberal…

Yup, and I’ve pretty much hit them all. Hell, even hit a few in this post alone but you zeroed into the charity thing and wouldn’t let go. Myself, when I see liberals talk about the poor and downtrodden, about how hard it was going to help those folks which forced them to miss all the high paying jobs meanwhile they were earning more them a majority of this country does AND gave a pittance to charity….I see hypocrisy.

I’m not surprised tho.

Trust me, I could provide some lovely examples of hypocrisy from McCain’s speech of two days ago (on the mortgage crisis) or Clinton’s recent comments on Wright (*snort*).

I’m a political centrist and a partisan Independent, simply because government is not a black-and-white choice between conservative and liberal, and because both major parties are filled with hypocrites. I sit back and see both sides inflate their records, spout obvious half-truths, and spawn useless threads while hoping that no one looks into their half of the political universe. (I can tell you that, after hearing 8 years of “I misspoke,” “I was less than candid” and “I can’t recall” from the current Administration, arguments around ‘misremembering’ don’t get a great deal of traction.)

Sadly, our political process has become one in which we are encouraged to vote against "the other guy" instead of voting for someone in whom we can honestly believe. In that context, I take a dim view of any word-parsing, semantic games or molehills-made-mountains.

(Yes, I make the same sorts of comments on other blogs–conservative and liberal–that I make here. I will say, by the way, that the atmosphere among commentators here is much better than the norm.)

I will say that I probably “zeroed in” on the charity thing because of your use/citation of the “well short of the biblical 10% tithe” comment. I take my faith very seriously (I’m a Southern Baptist), and I have grown disgusted with the casual way in which we’ve injected judgments of faith into the political debate. There’s a reason that the Founders explicitly prohibited religious tests for public office, but we seem intent on introducing them nonetheless. In that respect, you hit a nerve. *grin*

We do agree, I suspect, that the most important issue you raised in your original post was the question of Illinois ethics laws. That should be investigated further.

I could care less that the Tax Professor brought up religion….I care about the hypocrisy that is one display daily from Obama and his wife. You have examples of McCains hypocrisy, bring it. But when a man has become this holier then thou messiah you better damn well believe I will point out the mans hypocrisy.

McCain has made no such allusion, and has laid out his failings for all to see and judge. Not so with the messiah.

Curt wrote:

Given his years of decrying the influence of money in politics, I see hypocrisy in his recent attempt to get out from under the public financing for which he registered. This is especially true when he’s publicly criticizing Obama for doing the very same thing. (Yes, they’re both hypocrites on this one.)

It’s hypocrisy to assure the big banks/brokers that the Federal government will/should step in to save them from "systemic risk" in the mortgage crisis, while (in the same speech) preaching personal responsibility to everyone else.

I see hypocrisy in the contradiction between his public condemnation of waterboarding and his vote against legislation that would prohibit the practice.

It’s hypocritical to criticize others for discussing timetables or oversight of Iraq, when he himself proposed benchmarks–and the possible need to "examine the mission" if they went unmet–in early 2007.

When he, in 2008, describes Iraq as something that "many of us fully understood from the beginning would be a very, very difficult undertaking," after coughing up the "greeted as liberators" line repeatedly in 2003, I smell hypocrisy.

Urging Huckabee to stop aside in 2008–when he didn’t release his 2000 delegates until the day before the Republican Convention–strikes me as hypocritical.

Now, we can come up with long lists of this stuff from any of the remaining candidates. Such is a certainty in today’s political system. I just wish that I saw some discussion of how to answer these legitimate criticisms, instead of the head-in-the-sand, let’s-only-talk-about-the-other-guy nature of most sources of ‘discussion.’

I agree with all those. One of the reasons why he wasn’t my first, second, or even third choice for President. But it appears this election will be between the better of two evils, and Obama-Hillary beat him by a million miles in that regard. If you check the posts I did prior to him winning the nomination you will see many posts on McCain that were less then glowing. But now this election is about ensuring the Socialist twins do not get in and completely tear this country apart ala Jimmy Carter…unfortunately, for myself, I have to vote against someone rather then for someone.

Curt wrote:

Tell me about it. I consider this the greatest failing in contemporary American politics. It’s hard to remember the last time I genuinely voted FOR someone, rather than a lesser-of-two-evils vote AGAINST the "other guy."

2004 was the first and only time I genuinely voted for someone. 2000, didn’t know much about Bush to be really for or against him. Dole…..heh. Maybe Bush Sr but I can’t say I was genuinely behind him. I was 17 in 1984 and if I could of voted that would of been one….hell, I campaigned for Reagan in High School.