![]()

by BRUCE YANDLE

News from the Bureau of Labor Statistics (BLS) that February’s all-item Consumer Price Index (CPI) skyrocketed 7.9 percent on a year-over-year basis came as no surprise to American consumers. It was the largest increase since 1982 and followed increases exceeding 6 percent each month since September. Anyone who does the family shopping, as I do, or who keeps the family SUV or pickup truck full of gas has been seeing this coming for almost a year.

Expressing concern about soaring gasoline prices, President Joe Biden called it “Putin’s price hike.” While shifting the blame for inflation to a foreign despot may be attractive politically, the BLS report tells us that the price surge had nothing to do with Russia’s invasion of Ukraine on February 24, too late to have much impact on the monthlong survey of daily gasoline prices.

The BLS report showed the food index was up 7.9 percent for the year and, yes, gasoline was up 37.9 percent. It may be worth remembering that the U.S. average price of a gallon of gas in January 2021 was $2.38; in January 2022, the price was about a dollar higher at $3.32. By March 10, the price was another dollar higher at $4.31. Yes, Putin’s invasion is making a huge difference. But demand for gasoline surged much earlier when consumers, with money in the bank and uninterested in flying because of COVID-19 concerns, put family cars on the road in the midst of the great COVID shutdown, making the number of miles traveled in spring 2021 rise to new heights.

For too long now, our political leaders have been unwilling to accept the notion that their policies are the major source of inflation, that the inflation embedded in our economy is not transitory, that inflation is not just associated with sudden supply chain problems, and that inflation is not caused by business leaders suddenly becoming unusually greedy. Few have admitted inflation is created in Washington, here to stay, and likely to worsen over the next 12 months.

Many analysts (and even Biden’s Council of Economic Advisers) now recognize that, fed by trillions of stimulus dollars distributed in 2020–21, surging consumer demand placed extraordinary pressures on the straining supply of home appliances, automobiles, residential structures, gasoline, paint, and even cat food. With money flooding and consumers shopping, prices had to sail higher.

Obviously, this is not to say that war-generated market turmoil does not matter. Anything that significantly reduces the supply of important commodities will generate higher prices. And while what makes gasoline or anything else more expensive matters very little to consumers who have little choice but to pay the price, those who worry about government policy and what might be done to redress the situation know there is a difference between changes in the relative price of one commodity (say, gasoline) and changes in the overall price level for all commodities taken together, as seen in the CPI.

[the_ad id=”157875″]

Easing energy supply constraints and thus making gasoline cheaper will involve encouraging more drilling and more fracking, in addition to rethinking and revising regional formulation differences required by the Environmental Protection Agency that make gasoline more costly. We should remove anti-competition policies like the Jones Act, which bans foreign-built or foreign-owned vessels from U.S. coastal shipping, making it more costly to move petroleum products domestically.

But looking for ways to reduce overall inflation requires recognizing that inflation is first and foremost a monetary phenomenon. After all, the word itself refers to inflating the supply of money that then chases a limited supply of goods and services and thereby causes all prices to rise.

This gets us back to the trillions in printed stimulus money shipped happily to consumer checking accounts in 2020 and 2021. Early on, while the money printing presses were still running, noteworthy economists called for caution and predicted inflation would follow. Yes, much respected Florida State University* economist James D. Gwartney, Johns Hopkins University’s much-admired monetary scholar Steve Hanke, and former treasury secretary and presidential adviser Lawrence Summers each sent warnings, predicting that government spending based on printed money would deliver a serious bout of inflation. Washington leadership was in no mood to hear the advice. Meanwhile, the printing press kept running, and more spending was being proposed.

Now, we find ourselves with the predictable result.

It’s 100% Biden’s InflationThese soaring prices emanate directly from his systemic policy failures, and not from circumstances of the business cycle nor from the actions of any foreign leader, including Putin.

This Inflation explosion in the United States is firmly the fault of Joe Biden.

Biden shamefully lies to America when he tries to put the blame for his inflation crisis elsewhere. He had to gall to claim: “I’m sick of this stuff! The American people think the reason for inflation is the government spending more money. Simply. Not. True.”

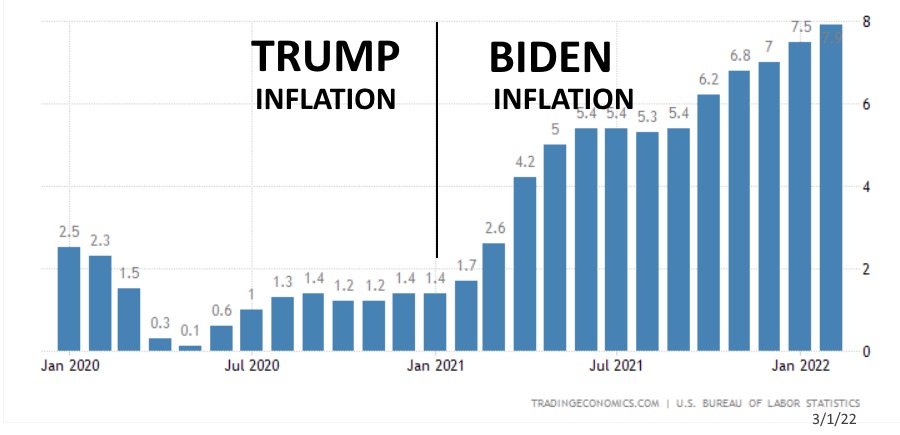

To prove just how dishonest Biden is, take a look at the trajectory inflation as measured by CPI, the Consumer Price Index.

Reviewing the last five years of inflation makes it crystal clear that under President Trump, overall pricing pressures remained stable, low, and predictable — even during the breakout Trump Boom economy into 2019, that American workers enjoyed pre-Covid.

As America emerged from the Spring 2020 lockdowns, pricing did not surge when Trump was still in office. Even as America aggressively re-opened, during the last 5 months of Trump’s term, inflation remained super low, beneath 1.4% in each of those months. But into the Spring of 2021, with Biden managing our economy, the pace of inflation rocketed higher, hitting an appalling 7.9% for the most recent data release.

There are three main policy failures of Biden that explain this runaway pricing…

I guarantee we are going to end fossil fuels’…

jackass biden in his own words;

CHART | Biden Inflation vs Trump Inflation

Even the pressure from Putin’s invasion is a direct result of idiot Biden’s foreign policy debacles. 100% the fault of idiot Biden, the idiots that voted for him and the idiots that chose to disregard the ample and clear evidence of election fraud, which got us to this point.

Each and every day we are gaslit with the democrat media approved propaganda that directs a narrative contrary what a clear majority of American know and believe.

11 When I was a child, I spoke as a child, I understood as a child, I thought as a child; but when I became a man, I put away childish things.

1 Corinthians 13:10-12

RIGHT!

RIGHT!

So, the only conclusions to draw here is that either Democrats have no earthly clue how economies works and how indiscriminately printing and distributing trillions and trillions of dollars negatively affects the economy or they don’t care about the destructive results of their policies and ruthlessly and remorselessly lie about their failures. Both, base on Democrat’s history, are very, very likely. It could even likely be both.

I hope Republicans make good use (for the American people) of the opportunity they are being handed.

BREAKING: US Producer Price Inflation Soars to 10.0% — Largest Annual Increse on Record

biden continues his assault on America

China is attending a state dinner in SA. How embarrassing that they would not even take a call from the jackass masquerading as the president

“This Is Entering the Dark Valley – Where It Starts Spinning Out of Control” – Steve Bannon Reacts to Breaking News of Saudi Arabia Moving to the Yuan (VIDEO)

Idiot Biden makes the US look weak. Saudi Arabia wants to curry favor with the strong, not the weak. If idiot Biden lets Putin win in Ukraine, US prestige, influence and power (which is essential to world peace and freedom) might take years or decades to repair, if it is even possible.

U.S. Retail Sales Collapse as Govt and Media Attempt Denial That Economy Is Contracting