![]()

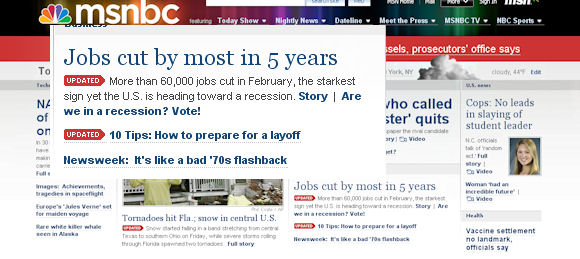

Isn’t it funny how the MSM chooses to highlight any negative economic report when it looks like they can use it to bash Bush and/or ensure they get a Socialist into office? When the economic reports were rosy you would have to dig and dig and dig to find any reporting on it, a few negative reports and every paper and news site across the globe pushes it to the front page:

The government reported today that the U.S. economy lost jobs in February for a second month running and at its fastest pace in five years, making it all the more certain that the nation is slipping into a recession.

“The world is coming to an end. Yes, you can quote me on that,” said David M. Jones, chief economist with Investors Security Trust in Fort Myers, Fla. “The payroll numbers were a surprising large drop, and just as important is the fact that we had a larger revised decline in January.”

“You almost never have back-to-back payroll declines without a recession,” he added.

The economy shed 63,000 jobs in February, the government said on Friday, the fastest falloff in five years and the strongest evidence yet that the nation is headed toward — or may already be in — a recession.

“I haven’t seen a job report this recessionary since the last recession,” said Jared Bernstein, an economist at the Economic Policy Institute in Washington. “This is a picture of a labor market becoming clearly infected by the contagion from the rest of the economy.”

Employers slashed 63,000 jobs in February, the most in five years and the starkest sign yet that the country is heading dangerously toward recession or is in one already.

It was the first monthly back-to-back job losses since May and June 2003, when the job market was still struggling to recover from the blows of the 2001 recession.

The health of the nation’s job market is a critical factor shaping how the overall economy fares. If companies continue to cut back on hiring, that will spell more trouble.

“It certainly solidifies the notion that the economy has fallen into a recession,” said Ken Mayland, economist at ClearView Economics.

Baaaad times right?

Well, it all depends on how you spin it. And the key word the MSM wants to spin is “recession.” Noel Shepperd caught the AP spinning it big time:

In fact, the AP’s Jeannine Aversa actually fabricated data that went completely contrary to what was reported. Take a close look at paragraph two of Aversa’s article published at Yahoo at 9:39AM (emphasis added):

The Labor Department’s report, released Friday, also showed that the nation’s unemployment rate dipped to 4.8 percent as hundreds of thousands of people — perhaps discouraged by their prospects — left the civilian labor force.

Um, NO! Here’s what the Labor Department specifically said about this issue in its Employment Situation Summary released at 8:30AM (emphasis added):

About 1.6 million persons (not seasonally adjusted) were marginally attachedto the labor force in February. These individuals wanted and were available forwork and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey. Among the marginally attached, there were 396,000 discouraged workers in February, about the same as a year earlier. Discouraged workers were not currently looking for work specifically because they believed no jobs were available for them. The other 1.2 million persons marginally attached to the labor force in February had not searched for work in the 4 weeks preceding the survey for reasons such as school attendance or family responsibilities.

See that phrase “about the same as a year earlier?” See anything about the number of discouraged workers increasing in February? Where did Aversa find such a claim by the Labor Department?

Tom Blumer dug even further into the AP’s spin machine:

- First, how does she know that “employer slashes” and “cuts,” as opposed to retirements, voluntary departures, and other forms of attrition, are the sole cause of the job losses? Answer: She doesn’t, but the imagery of employers doing violence to workers, a staple of AP reporting in this area, is apparently irresistible.

- Aversa’s minimization of the unemployment rate drop by attributing it to people leaving the workforce only works if you look at January. But, as seen in the core info above, the number of adults not in the labor force has gone up very little (+146,000).

- Her “perhaps discouraged workers” theory is an easy one to puncture. In fact, it’s debunked in the text of the BLS report, which says that “Among the marginally attached, there were 396,000 discouraged workers in February, about the same as a year earlier.” I looked it up — February 2007’s discouraged worker count was 375,000. (Update: NB’s Noel Sheppard also noted that January 2008’s “discouraged worker” number was a lot higher [467,000] than February’s.)

- She totally ignored the fact that the number of unemployed (i.e., the people we should be concerned about) dropped by almost 200,000 in February, and is now 284,000 (3.6%) lower than it was in December. That doesn’t exactly square with an economy Aversa says is “heading dangerously toward recession or is in one already.”

Every report out there just sidestepped the fact that the unemployment rate actually fell and keyed in on people were so “discouraged” they just stopped looking for work:

“Despite the drop in payroll employment, the unemployment rate fell to 4.8%, from 4.9%.”

“Would-be workers are also feeling more discouraged. Fewer Americans looked for work in February, and the size of the nation’s overall labor force declined. Those developments sent the unemployment rate down to 4.8 percent last month from 4.9 percent in January.”

“The formal unemployment rate actually fell slightly, from 4.9 percent to 4.8 percent. However that statistic is influenced by how many people are actively seeking work, a number which declined by 450,000 over the last month as people exited the job market.”

What to make of all this? On the one hand we have disappearing jobs and on the other we have declining unemployment rate. So instead of doing an analysis like this from First Trust Advisors (h/t The Corner)

Today’s report on payrolls is disappointing but not nearly as bad as many are making it out to be. Reports on layoffs in February ran below the level of February 2007 and unemployment claims are not signaling recession. What we have is a temporary hiring freeze at many firms in response to fears of a recession, not the kind of layoffs that occur during actual recessions. In addition, the February number may have been influenced by heavy snow that covered much of the US, particularly in the Midwest, which contains much of our nation’s manufacturing sector. This was layered on top of another understandable 26,000 loss in home building jobs.

The overall decline in payrolls in February is the second straight monthly drop, which rarely happens outside recessions. However, this is the first business cycle in history when Baby Boomers have started to retire. Negative payrolls in the 1980s and 1990s would have been a very bad sign given trend payroll growth of 200,000+ per month. In a world with trend payroll growth near 100,000, payroll declines are less indicative of recession. Also, the recent weakening in the labor market resembles the acceleration of post-recession job losses in early 2003, as fears mounted about the war with Iraq. That weakening was temporary, and we expect recent weakness to be temporary too. We were glad to see the unemployment rate tick down to 4.8% and note that the measure of the unemployment rate that includes “discouraged workers” also ticked down.

We get analysis from the MSM that is all spin, all the time. A recession feeding frenzy brought on to give the Democrats some talking points:

“Today’s dismal jobs new should put to rest any doubts that our economy is in deep trouble. We have now seen two straight months of job loss, and the 63,000 decline in February is the worst since March of 2003. This troubling news comes at the end of a week where oil topped $104 a barrel and we learned that home foreclosures hit an all time high in the fourth quarter of 2007,” Clinton said in a statement.

As we ponder the “deep trouble” we’re in I have one question: when was the last time we had a recession with a 4.8% unemployment rate?

Another homework assignment….watch this:

See author page

Oh of course. The liberal MSM has drumbed it so far into the far left’s head that we are going to hell in a henbasket that they start to believe it and they manage to sabotage it anyway they can!

Yeah and of course MSM also does that with the weather. All we ever here about is the bad weather; tornadoes, hurricanes, blizzards, why don’t we ever here about any GOOD weather?

Well I’ll tell you it is because people choose that media that tells them about the things that they want to know about.

Your problem isn’t what the MSM provides, your problem is that you don’t like the choices Americans make to get their news.

Americans have a wide range of media to choose from it sounds like some would like to have only orthodox or government approved media . I want it all available, the National Enquirer, The Wall Street Journal, The New York Times, Fox News, Entertainment Tonight,The Weekly Standard, MTV, Playboy, the 700 Club and everything else. I have confidence that Americans will choose correctly.

As for the economy Americans know how bad it is. You will have quite a bit of work to do if you want to try and convince people that the economy is doing well. Probably the most depressing paper I read is the Wall Street Journal, which most would consider an organ of the socialist party.

I would say the real bad news is the Baby Boomers retiring. I don’t buy this MSM conspiracy crap. Don’t get me wrong, I think they’re pure scum. But it’s more about selling advertising than pushing agendas…

Who said anything about the economy doing well? I didn’t write that…but you chose to spin it as such. Shocker!

The economy is slowing down, but there is no need for all the shock and awe reporting done by the MSM doing their best to get everyone worried when we are NOT in a recession….I just wonder what the reporting of this would be like if a Dem was in office.

Curt,

I remember the 2000 election and Bush being attacked for ‘talking down the economy” while the MSN was doing their best not to cover it.

Of course. It’s all the Liberal’s fault. George W. Bush and the Republicans can’t be held accountable for anything, ever, no matter what.

Today we learned that the net equity Americans held in their homes dipped below 50%. A level that has not been seen since the 1940’s.

And the reason the unemployment rate is “only” 4.8 percent is that the Department of Labor “adjusts” who is “unemployed”. If you have been without a full-time job for more than six months, you are no longer “unemployed” or “underemployed”. You are a “discouraged worker” and you are no longer counted in the totals.

Given the level of politicization that the Bush Administration has imposed on every other agency of the US government, from the CDC, to the US Attorneys’ Office (“Loyal Bushies” all), to the true cost of the Prescription Drug Entitlement, to FEMA, we all know how much to trust the Bush Administration on this number as well.

Beyond housing, things are generally cheap. My dad was making $30,000 a year as an electricin in the 1960s and owned two houses when he was in his 30s (the second costing less than $20,000 which he gained a profit of $600,000 30 years later). Now the average wage is around $48,000 and houses are $400,000+. On the other hand, he bough a brand new car for around $8,000 (not including taxes) at the time which I paid $14,500 (including taxes, loaded and extended warrenty) for a better car in 2000.

I found 80,000 good paying jobs right here.

http://www.railroadjobs.biz/index.htm

I got 2 million more fair paying jobs that need filling

http://www.nea.org/teachershortage/index.html

The army wants to add 100,000 more, the marines want 38,000 more.

The U.S. has a 85,000 shortage in firefighters and stortage of police that runs into the thousands

http://www.usatoday.com/news/nation/2004-11-28-police-shortages-cover_x.htm

There is now a shortage of 118,000 Registered Nurses which will rise to 340,000 by 2020.

http://www.aacn.nche.edu/Media/shortageresource.htm

Between 3,000-10,000 more doctors need to be trained per year.

http://www.usatoday.com/news/health/2005-03-02-doctor-shortage_x.htm

Generic worker boom news:

http://www.lukevision.com/jobboom.htm

>>Today we learned that the net equity Americans held in their homes dipped below 50%. A level that has not been seen since the 1940’s.>>

That’s an interesting statement. In my area, homes have increased about 500% since we bought ours 25 years ago. Obviously our equity has increased in the sense that we have most of our mortage paid off, but if you go by the numbers, it would seem to me that even if my home is 100% paid off, my net equity would still be only one fifth of it’s market value. Is that wrong?

Maybe I don’t understand where they’re coming up with their numbers…perhaps you could explain it?

Wouldn’t the result be the same if people bought and sold more frequently than in the ’40s? We have a much more mobile population today than then – wouldn’t that also have an effect on the net equity?

I would say that’s an average Suek. That’s also how they get the huge numbers for personnel debt. It’s based on multiple mortgages on the same property and mortages in the general population.

Let’s say you bought a $500,000 house and put $100,000 on that house. You have $100,000 in equity. If they house drops $100,000 to $400,000 you have $0 in equity. If it jumped to $600,000 you would have $200,000 in equity.

People use property to buy other property. That’s what rich people do. So a person has put down $100,000 on a $500,000 house then took that $100,000 in equity to buy another $500,000 house, then both houses dropped by $100,000 then the person has -$100,000 in equity. If people didn’t buy property more property, they were using their property as an ATM machine to buy boats, cars, fancy clothes, nice vacations etc. So even if they originally paid off their homes in full, they then turned around and tapped the equity.

This can get real bad for property since 75% of the households in the U.S. makes less than $57,000 while in the end most homes triple in price when adjusting for interest (then add any taxes, fees and upkeep). I believe in the 2 1/2 rule which was still taught in the 80s. It means the price of affordable property is 2 1/2 times ones gross income. That means that 75% of the households can afford less than a $142,500 home. Anything more is too expensive. The smart ones realized what was going on, flipped some property and got out before the bust.

We remember in 2005 applying for a loan and being offered a no doc loan for 1 million on a 65k salary. Sure we had some savings and equity in our current home but we knew that was absolutely ridiculous. I’ve never forgotten the 2.5 rule but apparently we were in the minority.

Beyond housing, things are generally cheap.

Housing and energy. Food is likely to follow energy in price as the rise in oil prices and the falling dollar (which leads to grain exports) work their way through the system. Manufactured goods should continue to be cheap for a long time.

Your point about jobs going unfilled is well taken though. Whatever problems we have, lack of jobs is not one of them. Any issues with unemployment can be effectively deferred until someone actually tries to defend the value of the currency. Of course, what’s effectively happening is that you’re taxing current holders of the currency in order to finance cheap lending (which leads to jobs).

I’m not going to say the current policy is indefensible (after all, the biggest single payer of the ‘inflation tax’ is the Chinese with their dollar reserves – maybe it’s not such a bad thing). But when someone starts down a path which has led so consistently to disaster in the past, I think a little skepticism and debate is in order.

There are also differences in financing…

I don’t know what the rules were in the 40s, but in the 60s, the rule was 20% down and a 20 year mortgage. I remember when I first heard about a _30_ year mortgage! Wow! that could really make a difference in your payments….but also Wow! did it ever increase what you ended up paying for your house! VA loans were a real bennie – no down, if you didn’t have any savings, but you paid points, and in the end, it was more costly. Still, a way for a family who hadn’t saved anything to get started. Now it seems, you need very little down, can get an interest only mortgage etc…it’s really no wonder that there’s so little equity. I think Greg’s explanation about using the equity for other purposes is only partly right – though it’s also a factor, no denying that.

I wonder how are we going to bring the economy back up though.