![]()

Keynesian economics has ruled the roost in American economic policy circles for decades, but there’s only one problem: it’s demonstrably wrong.

John Maynard Keynes, director of the British Eugenics Society, theorized that recessions could be ended by deficit spending. Governments could raise aggregate demand by running deficits, this would ‘prime the pump’, and the economy would grow again. If this were true, we would have had a rip-roaring economy ever since the 1970s when the federal government started to run large chronic deficits. We have been running deficits all that time (with minor exceptions around 2000) – even trillion-dollar deficits – but economic growth has been less than stellar throughout much of that period. In addition, big deficits didn’t work at all in Japan’s ‘Lost Decade, but CUTTING deficits did work in Thatcher’s England.

To these cases refuting Keynes, we can add the United States’ immediate post-World War II experience, Ireland (after the mid-1980s), New Zealand (the early 1990s), Sweden (1991), and even Canada (1990s), all instances when government shrank but the economy grew.

Another case: the deficit-fueled stimulus spending of 2008. If Keynes were correct, the $800 billion spent should have jolted us back to trendline growth but, as you can see from the next chart, that didn’t happen:

https://fred.stlouisfed.org/graph/fredgraph.png?g=cbnw

(red trendline added by a friend of The Truth)

The nail in the Keynesian coffin: the United States grew by leaps and bounds in the 19th Century when low government spending and deficits were the norm. So Keynesian economics is completely demolished by the historical record, if one cares to stick to the facts and not some weird beliefs about creating a super-race, er, super-economies.

Think about it: How does deficit spending raise ‘aggregate demand’? If government spends $1, did aggregate demand go up $1? No. The dollar was taxed or borrowed from someone else who was then unable to spend it themselves. The whole thing is a wash and, therefore, Keynesian economics is a wash-out as a matter of theory.

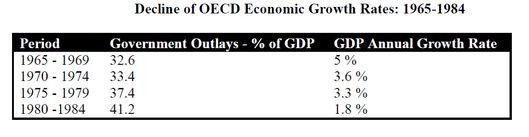

And as a matter of empiricism. The empirically-based Rahn Curve completely destroys Keynesian economics. The Rahn curve shows that government spending is a DRAG on the economy, not a multiplier, after government spending exceeds 15-25 percent of amount of GDP. Government spending in the U.S. is currently around 40 percent of GDP. There is no Keynesian multiplier effect when big bloated government sits on top of everybody, smothering economic dynamism. Keynesian economics holds that higher government spending produces higher economic growth, but the Rahn Curve shows just the opposite when government gets too big:

Mitchell cites several studies before reaching his bottom line: “Government today is far too big and this is hurting growth, undermining prosperity, and reducing competitiveness.”

Writing later for the Foundation for Economic Education, Mitchell parses more recent studies and finds additional support for the Rahn Curve. Quoting from studies:

- “a 10 percentage point fall in the share of national income taken in tax would lead to slightly more than a 1 percentage point increase in the growth rate – results of this order of magnitude occur over and over again.”

- “a fall in the tax rate by 25 per cent of its existing value (from about 40 per cent to about 30 per cent of national income in the UK) would lead to a rise in the growth rate to 2.7 per cent if the initial growth rate were 2 per cent.”

The above studies are buttressed by similar conclusions from Harvard professor Alberto Alesina, Goldman Sachs, and others.

The Rahn Curve has been criticized from the Left, but the criticism only quibbles around the edges – correlation is not causation, many factors influence economic growth, some types of government spending are better for growth than others, etc. Then, the critic does what every good Leftist does when confronted with an irrefutable argument – he tries to CHANGE THE SUBJECT: ‘the environment is more important than economic growth, anyway.’

Many professional economists don’t know about the Rahn Curve, but now you do. You now know enough to understand that the Progressives and other Keynesians don’t have the facts or history on their side. All they have is a superb political machine that, despite all evidence, lumbers on in the halls of power, still managing to dupe the unwary into believing that more government spending is good for the economy when it really isn’t.

But Leftist leaders themselves no longer believe in Keynes. The truth or falsity of the theory doesn’t matter to them and that’s because Keynesian economics is the best excuse ever invented for growing the government and empowering Leftists. Leftist leaders are not interested in the truth; they’re only interested in the career ladder that comes with never-ending deficit spending and big bloated government. To the Left, the issue is never the issue; the issue is always the revolution, and Leftist leaders will ride any horse they can to get there.

Any real debate about Keynesian economics should have ended decades ago. Henry Morgnethau, Jr., Treasury Secretary during the Great Depression, oversaw a Keynesian program for FDR and came away from it deeply cynical, completely disabused of his former weird belief that deficit spending could produce a super-recovery:

- We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest, and if I am wrong … somebody else can have my job. I want to see this country prosperous. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises. … I say after eight years of this Administration we have just as much unemployment as when we started. … And an enormous debt to boot.[13]

Crossposted from Liberato.us

Oh yes eugenics making the super human that will rule us all so when dose KHAN appear? when soon can we load him and his followers aboard the sleeper shot SS BOTANTY BAY and luanch them into deep space?

This post is an example of bait and switch. It attempts to prove something is not true by pointing to something else that is not true. Keynes died in 1946, not hardly the same economic world and times that the author uses to disprove Keynes. I don’t believe Keynes ever foresaw the governments of the world spending all their money on things with no return. Welfare, for example. If a government borrows a dollar from the Fed and gives it to someone that is not working and has no intention of ever using that dollar for anything that benefits anyone or any plans to ever repay that dollar, it has little chance of ‘creating’ benefits.

If you go back to Keynes times, when he postulated the thesis, it was a different world. Back then, if someone wanted to create wealth, they borrowed money and invested it with the intent to make enough money to benefit someone and to repay the money. Basically, all the money that is used in that method, does create a good economic situation. The period ‘after’ WWII was used as an example, but the period of WWII should be used as the true indicator. Almost all the money the government spent went to create jobs and wealth in the country. One can hardly argue that wasn’t successful. In contrast, look at CCC works and WPA works where the main effort was just to distribute money to keep people from starving to death. There was no return on that money. An attempt to prove Keynesian doesn’t work by applying that theory to any deficit spending situation that comes along is like applying the rules of democracy to the N. Korean government. There is little resemblance. So my question. What’s the point? If you look at the chart above the line for real domestic product slopes upward to the right. It makes little difference during times ‘more’ or ‘less’ deficit spending.

My point? I guess I don’t see the point in attempting to prove that Keynes econ theory doesn’t work by using economic situations that bare little or no resemblance to the Conditions for applying the theory. Perhaps the Keynes theory is correct for situations that do not involve government deficit spending and the Rahn Curve is correct when government deficit spending is the guiding principle.

@RedTeam: The government can’t create wealth – it can only redistribute wealth created by others

2012:

House Minority Whip Steny Hoyer (D-Md.) argued Tuesday that unemployment insurance and food stamps (which are included in the legislation) are the two “most stimulative” measures to boost economic growth.

2013:

“Unemployment benefits remain one of the best ways to grow the economy in a very immediate way,” House Minority Leader Nancy Pelosi (R-Calif.) said.

@Brother Bob:

exactly as I was saying. As in taking all the taxpayer money during the Viet Nam war and redistributing it to the LBJ buddies in Texas.

@Nanny G:

imagine, grow the economy by paying people to not work. Some sense of humor

Taking the personal property of one and giving it to another who did not earn it is theft.

Where are the pro choice alt-left who believe in choice?

Why is one who is self sufficient forced to subsidize others with whom one may not want to support?

If the moonbats in CA think they can withhold tax payments from the federal government, why could not a citizen withhold his personal property from the paracites who lay claim to another’s property?

I was taught Keynesian economics while a college student in 1959. It was theory, presented as unimpeachable fact. It was wrong. All of the “marginal propensity to spend” was an excuse for redistributing income. The theories of Keynes are right up there with macroeconomics.

This is an illustration of my theory, which that governments lack the ability to do good, they can only retard harm. Governments cannot provide welfare, but they can protect the poor from being defrauded. Governments cannot provide healthcare, but they can protect against charlatans and frauds. And so on.

My problem is that the progressive takes as an act of faith that governments do good. And I know of no evidence of any government doing good. Keynesian economics is a case in point.

2010: CNN: At a press conference in her home town of San Francisco, Pelosi explained that the program’s multiplier effect –the amount of money generated in the local economy as the result of the subsidy– far exceeds the nearly $60 billion spent this year by the federal government and is a sure-fire way to stimulate the economy. For every dollar a person receives in food stamps, Pelosi said that $1.79 is put back into the economy. The U.S. Department of Agriculture cites an even higher figure of $1.84.

Not only is this Keynesian economics, it’s voodoo math.

@mathman:

I disagree. Keynes theory had nothing to do with taking property from some and giving it to others for non productive reasons. It deals with investing money (borrowed) with the intent to make a producing business which returns more money than was invested (deficit spending) Do you disagree that the money Bill Gates invested (which he borrowed) has been a profitable investment? That’s Keynes theory and I can find nothing wrong with it. I don’t believe his theory included the government borrowing money and giving it away with no expectations of it being used for anything useful. If you can find some evidence that it did, I’d like to hear about it.

@John:

While I’ll agree that it may well be voodoo math, it bears no resemblance to Keynesian economic theory. Just because someone uses the term to describe why deficit government spending does not create jobs or wealth, does not mean it is Keynes Theory. For his theory, I think you have go back to what he said, not what is now being said about his theory.

What would you think about government deficit spending from 1942-45, vs government deficit spending 1946-1950? Consider this point: If deficit spending to create prosperity does not work, would any bank make a business loan?

Both Eugenics and human cloning should to totaly banned

Good post! Thank you!