![]()

There’s something macabre about an imminent train wreck, you know exactly what is coming but you can’t help but watching. Now imagine that instead of watching that train wreck from atop a building a safe distance away, you’re standing right between the train and the tanker truck that has stalled on the tracks. That’s a different story all together. At that point, rather than being a mere fascination it’s a matter of life or death. You’ve seen the damage a train wreck can do. That’s why it was fascinating in the first place. The difference now of courses is that when that giant mushroom cloud of smoke goes up, you’re going to be part of it. So, just as instinct kept you looking at the train in the first scenario, in the second one it causes you to turn and run as fast as you possibly can. If you can only get far enough away, you can avoid both the explosion and the crushing impact of one of the derailed cars rolling over you.

Well, you might want to think about running in real life, but it has nothing to do with train tracks or tanker trucks. It has everything to do with Barack Obama and the left’s train wreck of economic policy.

As virtually every conscious American knows, the United States economy took a body blow in 2008 with the financial collapse. Despite what anyone tells you, the collapse was 100% the product of government policies stretching back to Jimmy Carter and doubled down on by Bill Clinton. That policy, in a nutshell, was called the Community Reinvestment Act. The act “encouraged” banks and mortgage lenders “to help meet the credit needs of the local communities in which they are chartered consistent with the safe and sound operation of such institutions.” Essentially, banks were being forced to make loans in the communities in which their depositors lived.

Now, think about that. People put their money in banks in order to save it and maybe grow it a little bit. They want more security than what they might get by putting the money under their mattresses. Now, the government comes along and says that banks, rather than lending money in the safest and most profitable manner possible, must lend in particular neighborhoods, regardless of the opportunity to do so profitably.

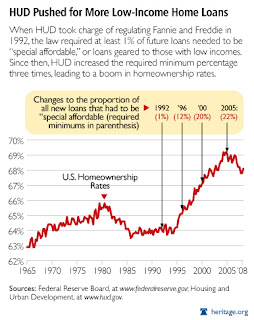

But of course the government didn’t stop there. They then decided that banks were not making enough home loans to minorities and decided to force them to do so. So now, banks, not only have to lend in certain neighborhoods, but they have to make loans to certain people, regardless of their creditworthiness. By 2005 fully 22% of new mortgages had to be “special affordable” loans targeted at low income buyers.

Banks of course complied, with a wide variety of special loan products from zero money down to ARMs and no income verification. And just to make sure that banks were making the loans, the government, in the form of Fannie Mae and Freddie Mac were assuming the risk by buying the mortgages. If that sounds like a disaster in the making… it was. The resulting financial collapse saw the evaporation of trillions of dollars of citizens’ savings and investments, not to mention sending the economy into a recession.

The government essentially manipulated lending data and created a financial train wreck and we were all forced to stand by and watch the whole thing. Thankfully most people avoided getting immolated in the flames, even if their hair and clothes got a little singed along the way.

In a rational world, having survived the meltdown and struggling to get the economy back on its feet the government would have learned its lesson and gotten out of the financial manipulation business. Not so much.

The Obama administration believes the “recovery” is leaving too many people behind. As such, it has decided that banks once again need to be “encouraged” to make more loans to low income, high risk borrowers. But it’s not just encouraging banks to do so, it’s facilitating their doing so, in the exact same manner Fannie Mae and Freddie Mac did before the collapse. Only now, instead of those two failed institutions playing the heavy it’s the Federal Housing Administration (FHA) that is putting taxpayer’s money behind the risky loans.

This policy shows everything one would ever need to know about liberals in general and Barack Obama in particular. In the face of crystal clear evidence that such a policy is a recipe for a financial disaster with seismic repercussions, they don’t care. Their ideology trumps reality. They are willing, even in a time of dire straits, to put the economy in peril simply to support their fiction that the rich are discriminating against the poor and minorities.

At the end of the day one has to wonder what is going through the heads of the people running Washington. This is the logical outcome of their willing ignorance in relation to the causes of the financial collapse. Their “greedy banks” screeds may have had a sliver of truth to them, but banks were in no way the proximate cause of the meltdown. There were indeed greedy bankers who made lots of money, sometimes off of poor people, but they were enabled and incentivized by government policy.

One would think with the economy still limping along with the injuries suffered in the derailment of a mere four years ago, that reality would replace ideology. Apparently not so much. This of course is a dance we’ve seen played out many times before. From Athens to Paris to Caracas, populist messages may bring electoral victory, but they rarely deliver economic victory. As Washington embarks on this suicidal populist train wreck, you may want to consider averting your eyes and figure out how to avoid getting crushed when the predictable damage begins…

See author page

Insanity; doing the same thing over and over and expecting a different result. Here we go again. Didn’t anyone pay attention the last time we did this?

The left has spent 5 long years laying the smoke screen that the recession was the result of those ubiquitous “Bush economic policies” (of which no one can name a single one) that caused the recession, not reckless, ignorant left wing social engineering. Perhaps it was all to this purpose… so they can pick up where they left off and finish off the economy.

Since 1965 we have plowed over $17 trillion into social programs designed by the left. We now have a greater number in poverty than we did when the “War on Poverty” began. Are these failures the result of stupidity or by design?

He learned from history — AND IS repeating it on purpose!!

@Bill: By design!

@Old Guy: The real insanity is sitting back and wondering if the repeaters are insane — when they are in fact repeating on purpose IN ORDER to obtain the same result!

Go to this website and scroll down to the list of plaintiff’s lawyers.

This is where the whole economic mess started.

http://www.clearinghouse.net/detail.php?id=10112

Obama’s goal is to destroy this country before he leaves office. When is someone going to have the balls to stop him?

Let’s not let Dubya off the hook here – note on the graph the years where these loans took off. I’m not making any excuses for the lefties – they deserve their share of blame in all of this, too.

Part of the problem that got us to this point is that we conservatives should have spoken up sooner when Bush & Lott betrayed our principles and went full throttle big government.

Ah, well, if you can’t stop it, might as well roll with it.

Houses become easier to buy.

House prices go up.

I sell what I’ve bought in forclosures.

Loan defaults begin again.

I buy them back.

Just another evil capitalist, that’s me.

And the great wheel of life keeps turning…..

@Brother Bob:

Bingo! Expanding the federal government is expanding the federal government, no matter who does it, and anyone who considers themselves conservative or classic liberal, or libertarian, should be speaking out against it no matter who is pushing that particular envelope.

@Brother Bob:

I didn’t support Bush or many of his “establishment Republican” policies, but in fairness I would point out that all this started under Bill Clinton’s administration and that Bush “inherited” the “real estate bubble” set-up, that was bound to come crashing down eventually. Granted the Bush administration perhaps didn’t see it coming, and may even be considered asleep at the wheel, but they were continually being distracted by (then) current events and a hostile MSM. As long as the economy seemed to be chugging along smoothly, (remembering that all the banking manipulations and “investment” loan packaging was going on somewhat under the table,) I can forgive George for not being made aware of the coming (at the end of his administration,) crash. What was intolerable however, is that the bankers and loan “investment” packagers were undeserving bailed out and profited from their fiduciary scams, and that the MSM never exposed the various Democrat official’s involvement that made it all possible.

@John Galt: You had a great comment a while back (last summer or fall I believe) that I looked for not too long ago but couldn’t find. You explained the leftist of both parties – the big government Democrat leftists and the corporatist Republican leftists. If this rings a bell with you & you know where it is please let me know – you did a nice job of summing up what’s wrong with both parties.

@Ditto: I think you’re being too fair w/ Dubya. His inheriting that is sort of like the same excuse of the current administration inheriting the Bush economy. And although I haven’t been able to independently verify this, I do know a few folks who worked for the Bush team who said that that administration ramped things up by pushing the FHA loans from the regular mortgages to the subprimes. And I also hear that early in 2008 that the insiders knew that the house of cards was coming down. Like any “insider info” take that with a grain of salt. But even without that last piece Bush still betrayed our conservative principles in a way that I’ve argued that Obama’s 1st term could have passed for Bush’s 3rd term.

@Brother Bob:

Lacking inside info on the Bush administration, I can’t comment one way or the other on whether Bush also pushed for subprime loans. Considering that Establishment Republicans are more for corporatism favoring big business and big bankers (ie. their cronies), rather than capitalism which favors everyone, it would not be too far of a stretch for him to have had some involvement. All I can cover is what I know of the situation, and agree with you that Bush was definitely NOT a conservative.

@Brother Bob:

The only problem with that is that the people who support the left in this country will never admit that their chosen party even has anything wrong with it. And sure, there are some on the right who would never admit to anything being wrong with the Republican party, but those typically are the same people who don’t believe that the establishment GOP is taking the party in the wrong direction.

Both parties, considering the leadership of them, have a welfare mentality. For the Democrats, it’s the obvious one of welfare for the “poor”, while the Republican party promotes welfare for business(though it has been shown that even the Democrats will dabble in this, depending on the business or industry).

If the country continues down the path it is going, regardless of who is in power, I see a very painful future for all Americans, regardless of where they are now.

I was looking for our other resident lefty Liberals/democrats jumping on this band wagon….why are they not here defending this?? Where are they????

The left and liberals and democrats are epitome of dumbed down America and that includes our leaders….

The Jobs in this economy are weak to nil and now we have the democrats talking about this again…. Yet the democrats have the nerve to say those on the Right are out of touch with reality…. OMG!!

80% of the subprimes were made not by Fannie or Freddie but by private banks, Yoday Fannie paid off another 20 billion they have now paid back 80% of what they borrowed fron the Feds. Oh and they should be able to pay the rest back in2-3 years. Last year Fannie made a 20 billion profit. Maybe the problems started way back when BUT they sure did ctash under Bush and under a GOP Congress for 20 years

Sorry john, but such a naive statement begs correcting.

The GSEs (which are Fannie/Freddie), do not “make” any loans… subprime, prime, Alt A, yada yada. They buy loans on the secondary market.

*ALL* loans are “made” by private banks, brokers for various banks, credit unions, etc. Loan originators use one of two electronic qualifying systems for loans that are sold to the GSEs *before* they make the loans, and during the application process. DU and LPI. These systems yield accepts or rejects for a buyer’s criteria. Ergo, before the loan is closed, and during the time of application, the lender will know whether Fannie/Freddie will purchase that loan on the secondary market.

And because the GSEs had been lowering their threshold for accepting loans since the 90s, plus increasing their portfolio of assets, they were the leaders in buying subprime loans hands over fist… leading both in the amount of years they were engaged in purchasing, plus the volume.

The private investment world didn’t get involved until later, seeing that the GSEs were cornering the market on the windfall. They had been cashing in since Clinton years after 1996, and they again lowered standards in 1999 to get even more quasi qualified borrowers approved by the GSEs. This was a systemic problem that really started leering it’s head, and taking off in the late 90s. I realize you so want to tie this to Bush, but he presided over the housing tsunami, created by Clinton and his Treasury. The GOP held Congress doesn’t get a pass either, but it wasn’t as tho the warning signs were famously discussed in 2004 hearings. Perhaps you missed it? That’s when Maxine Waters and a few others insisted that the GSEs were not in trouble.

Now the new problem is FHA… saddled with loans with only 3.5% equity at closing, and too large of a leveraged portfolio. It has been the loan of choice since the crash.

I think the below graph, sourced from CBO data, will easily show you that your figures are incorrect on sheer volume. And in fact, the private investment securitization didn’t surpass the GSEs until 2004, and not by much volume at that. They only led for a few years, and their volume was not significantly higher.

Hence, your claim about “80%” is pie in the sky propaganda, bearing no relationship to fact. In your desperate desire to blame private financials, you have chosen to remain deliberately blind to the data on the GSEs, which was guided and regulated by two administrations prior to this one. Obama is now making the same mistake… attempting to get standards lowered.

This same graph appears in my “Perfect Storm” post back from 2008. Maybe you need to go back and read some current events, as you seem to have conveniently forgotten. You’ll find the link to that post in the frames on the right, under “Highlighted Posts/Economy”.

@MataHarley:

john’s “GOP congress for 20 years” also needs correcting. Or, at least, his math skills.